how much does illinois tax on paychecks

No Illinois cities charge a local income tax on top of the state income. Employers can find the exact amount.

As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4.

. 2022 Federal Tax Withholding Calculator. No Illinois cities charge a local income tax on top of the. She uses this extensive experience to answer your.

Set up a free consultation with one of our experts. Ad 1-800Accountant provides tax and accounting services tailored to your state and industry. You exceed 12000 in withholding during a quarter it is your responsibility to begin to pay your Illinois withholding income tax semi-weekly in the following quarter the remainder of the year.

Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. No state-level payroll tax. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

Illinois Hourly Paycheck Calculator. Personal Income Tax in Illinois. Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools.

Personal income tax in Illinois is a flat 495 for 20221. What is the tax rate in Illinois for paychecks. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. This calculator is a tool to estimate how much federal income tax will be withheld. Accounting services from 125 a month.

Set up a free consultation with one of our experts. Although you might be tempted to take an employees earnings and multiply by 495 to come to a. Fast easy accurate payroll and tax so you save.

Accounting services from 125 a month. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. Ad 1-800Accountant provides tax and accounting services tailored to your state and industry.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. This is a projection based on information you provide. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Illinois has a flat income tax of 495 which means everyones income in illinois is taxed at the same rate by the state. According to the Illinois Department of Revenue all incomes are created.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

Are Relocation Expenses For Employees Taxable When Paid By An Employer

Need To Stop Wage Garnishment Are You Wondering What You Can Do To Avoid It Wage Garnishments Can Be Rel Wage Garnishment Tax Lawyer Debt Payoff Printables

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

How The Irs Will Treat Those One Time Tax Bonuses

How To Calculate Payroll Taxes Methods Examples More

Trail In Campton Ky Places To See Walking Trails Trail

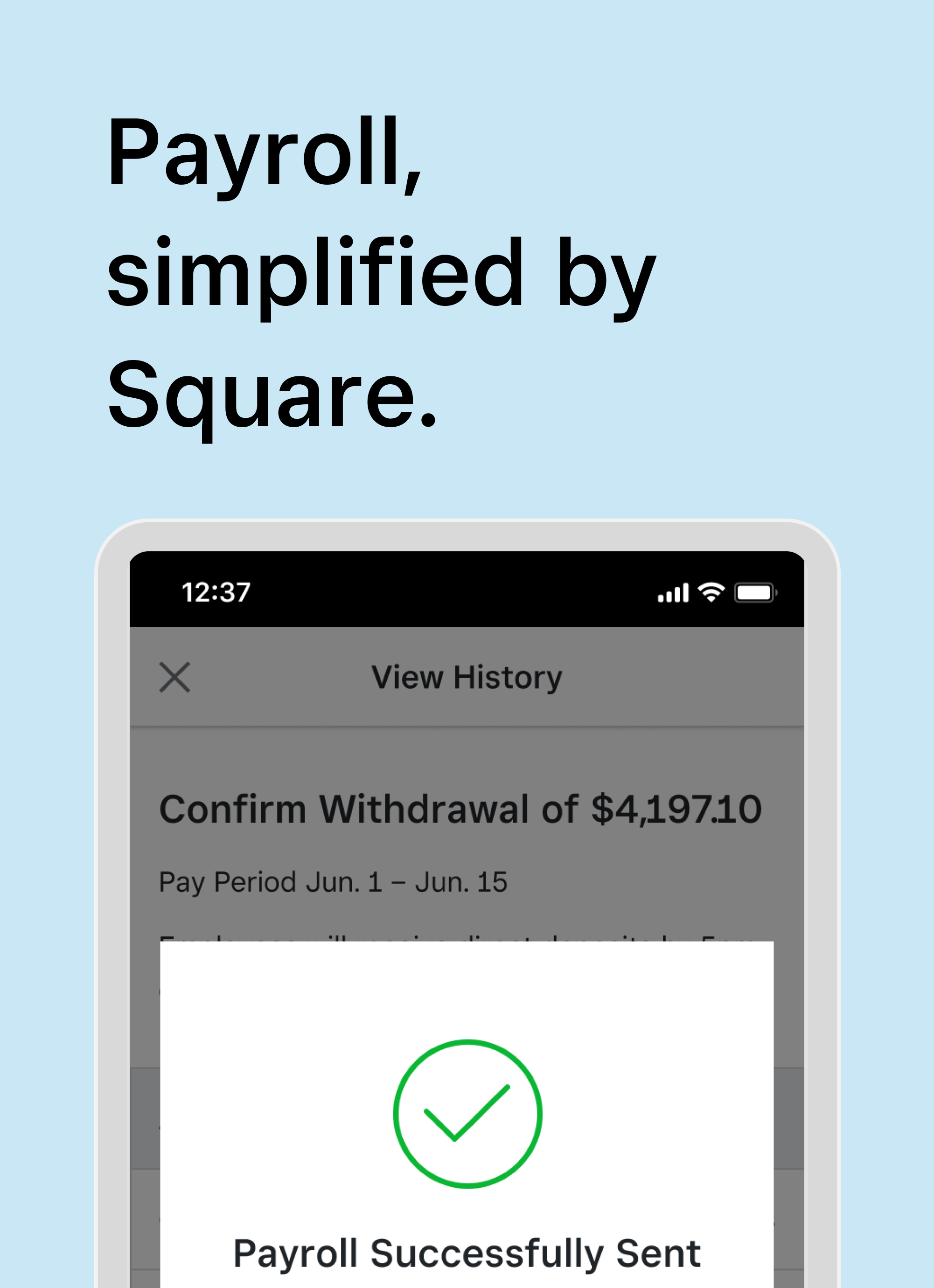

Payroll Taxes In 2020 Federal State Tax Information Square

1 200 After Tax Us Breakdown August 2022 Incomeaftertax Com

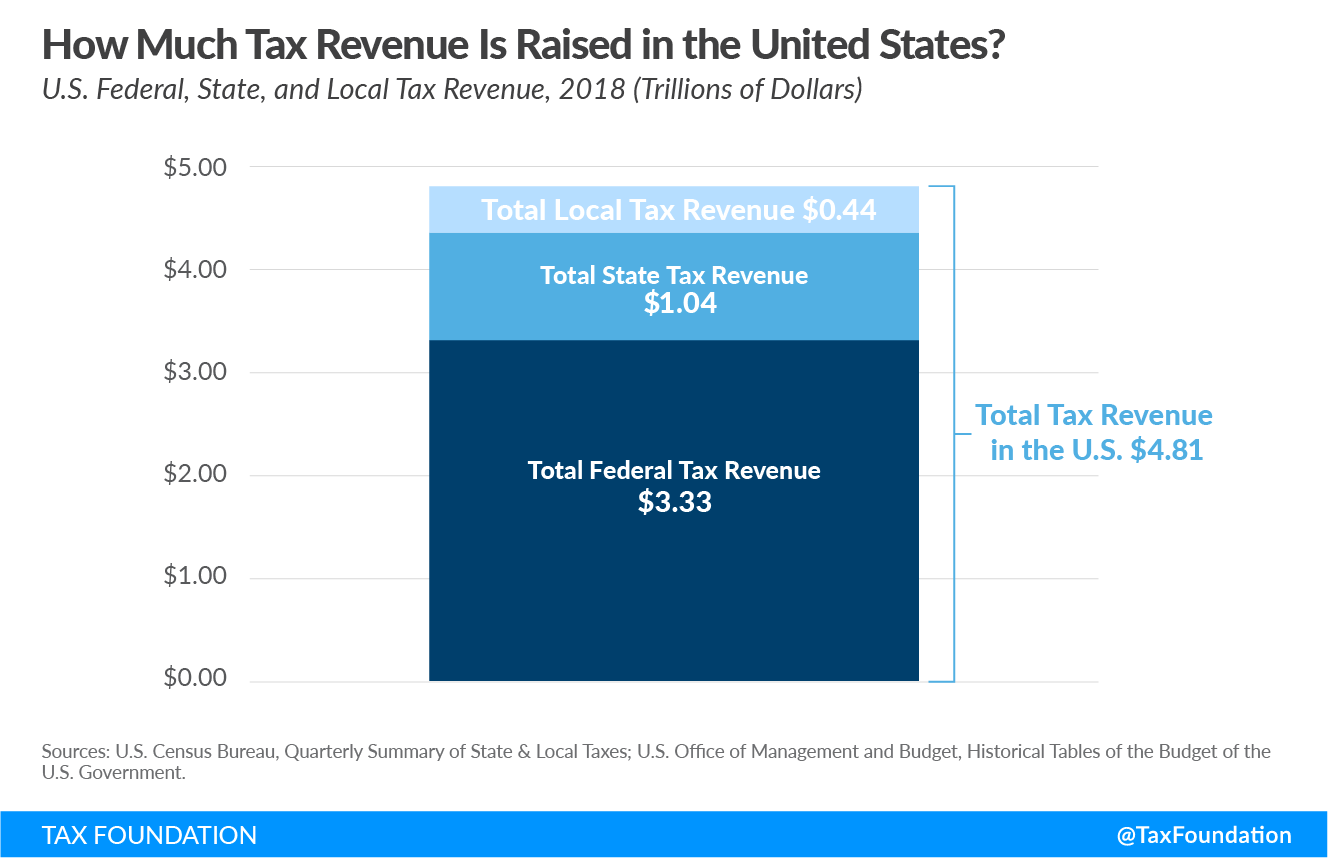

Government Revenue Taxes Are The Price We Pay For Government

2022 Sales Tax Holidays Back To School Tax Free Weekend Events

Government Revenue Taxes Are The Price We Pay For Government

How To Calculate Payroll Taxes Methods Examples More

Raymond J Busch Ltd Now Serving You From Two Locations 13011 S 104th Ave Suite 200 Small Business Accounting Services Business Accounting Information

Bonus Time How Bonuses Are Taxed And Treated By The Irs The Turbotax Blog

Payroll Taxes In 2020 Federal State Tax Information Square

Illinois Paycheck Calculator Smartasset

Hollywood Unlocked On Instagram Cash Is King But Credit Is Power Go Follow Financial Guru Coachlegen Credit Repair Credit Education Credit Repair Business

Government Revenue Taxes Are The Price We Pay For Government