ontario ca sales tax calculator

Ontarios indexing factor for 2021 is 09. This rate is the same since july 1st 2010.

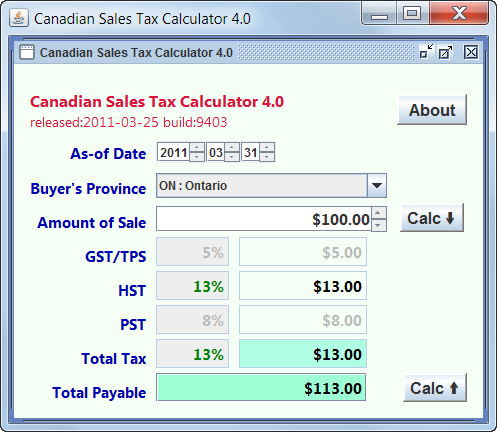

Canadian Gst Hst Pst Tps Tvq Qst Sales Tax Calculator

The Ontario Basic Personal Amount was 10783 in 2020.

. Ontario Sales Tax HST Calculator 2021 WOWAca. Determine your taxable income by deducting any pre-tax contributions to benefits. Province of Sale Select the province where the product buyer is located.

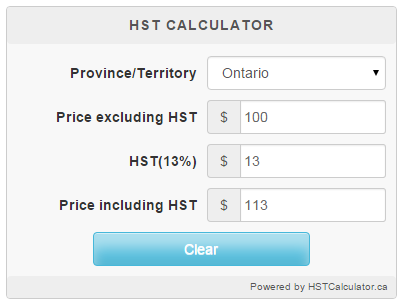

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. 100 13 HST 113 total. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Any input field can be used. This is very simple HST calculator for Ontario province. 91758 91761 91762 91764 91798.

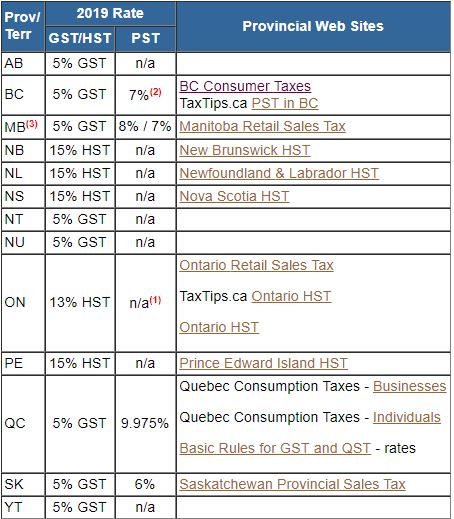

It is essentially the General Sales Tax and a Provincial Sales Tax rolled into one. The Ontario Trillium Benefit helps people pay for energy costs and provides relief for sales and property tax. 14 rows GSTHST provincial rates table.

Ontario applies 13 HST to most purchases meaning a 13 total sales tax rate. For tax rates in other cities see California sales taxes by city and county. The California sales tax rate is currently.

Look up the current sales and use tax rate by address. HST stands for Harmonized Sales Tax. Province of residence Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon.

Press Calculate and youll see the tax amounts as well as the grand total subtotal taxes appear in the fields below. Wayfair Inc affect California. The HST for Ontario is calculated from Ontario rate 8 and Canada rate 5 for a total of 13.

Integrate Vertex seamlessly to the systems you already use. To calculate the subtotal amount and sales taxes from a total. The following table provides the GST.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Ontario CA. The second tax bracket at 915 is increasing to an upper range of 90287 from the previous 89482. The December 2020 total local sales tax rate was also 7750.

Historical Sales Tax Rates for Ontario 2022 2021 2020. Ad Lookup Sales Tax Rates For Free. There is no applicable city tax.

Youll enter your gross per year salary. Did South Dakota v. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Formula for reverse calculating HST in Ontario Amount with sales tax 1 HST rate100 Amount without sales tax. This credit is a tax-free payment to help you with your property taxes and sales tax on energy costs. OR Enter HST value and get HST inclusive and HST exclusive prices.

Eligibility for the 2022 benefit year July 2022 June 2023 To qualify you must be a resident of Ontario on December 31 2021 and at least one. Income Tax Calculator Ontario 2021 Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The HST for Ontario is calculated from Ontario rate 8 and Canada rate 5 for a total of 13.

The Ontario sales tax rate is. OR Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price. Here is a step-by-step process to calculate your Ontario net income.

The information deisplayed in the Ontario Tax Brackets for 2022 is used for the 2022 Ontario Tax Calculator 2022 Income Tax in Ontario is calculated separately for Federal tax commitments and Ontario Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location. Sales tax in Ontario Here is an example of how Ontario applies sales tax. Affordable Housing and Homelessness Prevention Programs.

To calculate your Ontario net salary use an Ontario tax calculator of your choice. That means that your net pay will be 37957 per year or 3163 per month. Ensure that the Find Subtotal before tax tab is selected.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. This is an easy tool to use to calculate your net salary. Sales Tax Breakdown Ontario Details Ontario CA is in San Bernardino County.

California has a 6 statewide sales tax rate but also has 475 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2618 on top. Sales taxes make up a significant portion of Ontarios budgetRevenues from sales taxes such as the HST and RST are expected to total 281 billion or 265 of all of Ontarios taxation revenue during the 2019 fiscal yearThis is greater than revenue from Ontarios Corporation Tax Health Premium and. You can print a 775 sales tax table here.

Formula for calculating HST in Ontario Amount without sales tax x HST rate100 Amount of HST in Ontario Amount without sales tax HST amount Total amount with sales taxes Example 100 x 13100 13 100 13 113 HST changes. Your average tax rate is 270 and your marginal tax rate is 353. 1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The amount of taxable income that applies to the first tax bracket at 505 is increasing from 44740 to 45142. Ontario is in the following zip codes.

Ontario CA Sales Tax Rate The current total local sales tax rate in Ontario CA is 7750. Ontario ca sales tax calculator Friday March 4 2022 Edit New Homes For Sale In Covina California Get In On The Groundbreaking At Citrus Promenade Up To 2 055 Sq Ft 3 Covina New Homes For Sale Connected Home. Interactive Tax Map Unlimited Use.

Calculating sales tax in Ontario is easy. The 775 sales tax rate in Ontario consists of 6 California state sales tax 025 San Bernardino County sales tax and 15 Special tax. The County sales tax rate is.

This is the total of state county and city sales tax rates. No change on the HST rate as been made for Ontario in 2022. Enter price without HST HST value and price including HST will be calculated.

The minimum combined 2022 sales tax rate for Ontario California is. It combines the payments of 3 tax credits into 1 payment.

Gst Calculator Goods And Services Tax Calculation

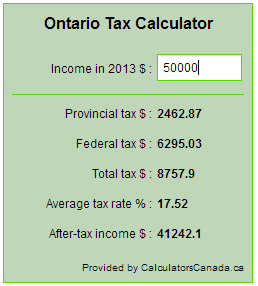

Income Tax Calculator Calculatorscanada Ca

Ontario Hst Calculator 2020 Hstcalculator Ca

Pst Calculator Calculatorscanada Ca

Taxtips Ca 2019 Sales Tax Rates For Pst Gst And Hst In Each Province

Canada Sales Tax Gst Hst Calculator Wowa Ca

Land Transfer Tax And Cmhc Calculators For Your Website Ratehub Ca

Income Tax Calculator Wordpress Widget Calculatorscanada Ca

2021 2022 Income Tax Calculator Canada Wowa Ca

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

Ontario Income Tax Calculator Wowa Ca

Ontario Income Tax Calculator Calculatorscanada Ca

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips